The Enduring Lie by regular correspondent Scott Egner.

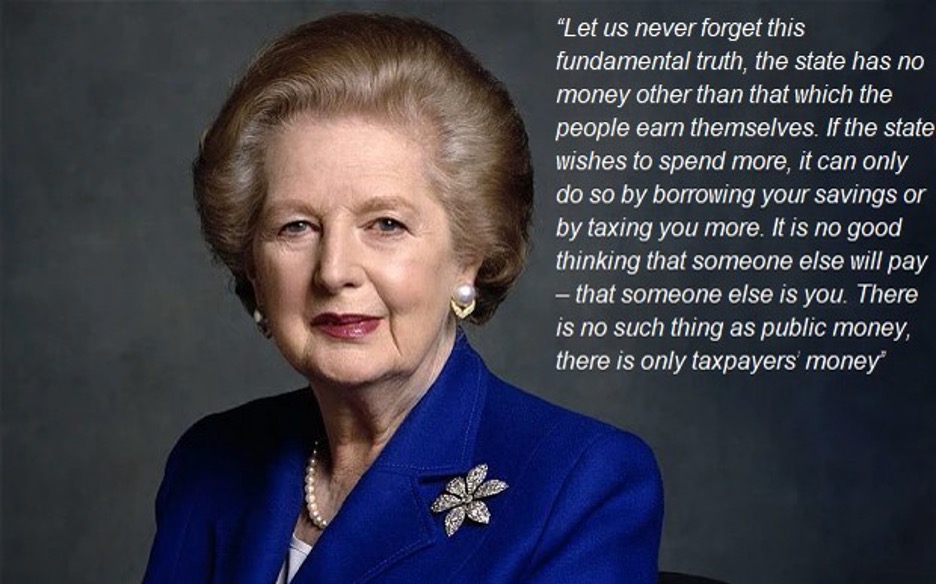

I have basically tuned out of any election commentary and I’m sure I won’t be alone. One thing we can bank on after 4th July, is that many people will continue to suffer. The economic ideology that continues to persist was encapsulated in the above quote by Margaret Thatcher during a speech in 1983.

I don’t remember this speech at the time – I had far better things to do like play football in the street, or ride my bike, blissfully ignorant at how profound an effect it would have on society. Some of course have profited, yet many have suffered. The saddest part, as we are seeing in the run up to the General Election, is that the entire political spectrum continues to buy into this pervasive lie.

To this day, most of us have simply taken her statement about money as read, but do we ever stop to really examine its veracity?

The U.K. has run fiscal deficits in most years, with a resultant year on year increase in national debt. In 1983 the U.K. national debt was £128BN. By 1993, it was over $200BN, and £450BN in 2003. Today it stands at around £2.7 trillion. It seems that thanks to all these ‘investors’, more money keeps being made available. How come we never hear our media ask inconvenient questions like; how does this so-called ‘finite’ pot of money continue to expand? Where does it come from? Who created it?

You might be surprised to hear that there isn’t any coherent explanation for this in mainstream economics. To quote celebrated British economist Frank Hahn, “The most serious challenge that the existence of money poses to the theorist is thus: the best developed model of the economy cannot find room for it”.

The creation of coins and notes is a function of a nation’s mint and central bank respectively. U.K. Commercial Banks were prohibited from issuing their own notes independently of the Bank of England, via the Bank Charter Act of 1844. Nowadays the quantity of notes and coins in circulation makes up less than 3% of the money supply and that percentage is falling.

So, given that mainstream models are not instructive on the matter, how DOES this ever present and ‘ever-increasing’ pot of electronic money that ‘funds’ governments come into existence in the first place?

Well, there are only two legitimate routes.

One route is via bank credit creation where money is literally borrowed into existence when we take out a bank loan. Conversely, repayment of the loan extinguishes that money. A considerable proportion of money in the economy today exists in the form of bank credit and U.K. Household debt currently stands at approximately £1.9 trillion

Banks are granted the privilege of creating money in this way under state license, but that’s not the end of the story. The state, via its central bank, accommodates and guarantees the integrity of the banking system every day by ensuring that there are adequate levels of ‘reserves’ in the system to fulfill millions of daily transfers. The term ‘reserve’ is an anachronism and more appropriate to a time when currencies were tied to quantities of gold and silver. They are simply a form of electronic state cash keystroked in and out of existence. Only one entity can issue and remove reserves from the economy, and that is the Government’s central bank. Payments settled using central bank reserves each day amount to around 15-20% of GDP!

In the case of a currency issuing government like the U.K, the other form of money creation is through government spending. As the monopoly issuer of sterling, the government, via the Bank of England, spends by creating new money into the economy. If the government pays me £1000 in benefits, it creates a new £1000 into my bank’s reserve account at the Bank of England. My bank also marks up my personal current account by £1000. When we settle a tax bill, we will see a debit item on our deposit account, but our bank will also have its reserve account debited by the same amount and the reserves are extinguished. It is important to understand that tax is paid in state money which has ALREADY been issued into the economy. It makes no sense then to suggest that money returned in taxes is used to fund government spending. It would be a bit like saying that eggs are made from omellet! We talk about tax ‘revenue’. The word revenue is derived from ‘revenu’, which originally meant ‘return’. We are returning that previously issued.

But what about government bonds. We associate those with the purpose of borrowing, right?

Interest bearing bonds were relevant and important in the age of fixed interest rates, where currency was convertible into gold or silver. They were a useful means of deferring claims on precious metal reserves held at the central bank. The treasury would far rather just pay you a rate of interest on your holdings of currency than run down its finite stock of gold and face potential default.

During national crises, there was a tendency to suspend gold or silver convertibility to give governments a greater degree of budget flexibility. During the Vietnam war, France’s President De-Gaulle was so concerned that U.S. war spending would impact the integrity of dollar-gold convertibility that he dispatched a destroyer to New York to exchange his dollar reserves for gold. Shortly after, President Nixon, ended the gold standard for good, and thereafter most currencies were issued by fiat – in other words, they weren’t backed by anything.

Today, bond issuance is still a necessary means of borrowing if you’re a country which doesn’t issue its own currency, but this is certainly not the case for a currency issuer like the U.K. Up until the financial crisis, bond sales were used to control the quantity of reserves in the banking system to maintain control of interest rates. Large infrastructure spending by the state for example, causes a large increase in reserves. Banks would then swap these newly created reserves for interest bearing government bonds to earn interest income, and the central bank would hit its interest rate target. So, bonds issuance takes place AFTER the government has spent the money. They have nothing to do with funding the government.

The aftermath of the financial crisis saw the introduction of Quantitative Easing (QE) which saw central banks buy back bonds and flood the banking system with reserves. Since then, Central banks have simply paid interest on reserves held in banks’ settlement accounts. Today the banks are receiving a tidy 5.25% (the base rate) on their reserve holdings. So, bonds became redundant for reserve management, yet continue to be issued.

There is some very good educational content on how all of this works on the websites of Central Banks, yet economists continue to parrot an archaic narrative. So why then do currency issuers like the U.K. U.S. Australia etc. continue to issue debt?

Well, interest paid on bonds benefits the asset holders – think of it as a basic income for the wealthy with every interest rate rise a welcome bonus. Government bonds are also a zero-risk asset and as such form the cornerstone of financial markets and are a pricing benchmark for other market assets. This is the reason that a nation like Norway which tends to run fiscal surpluses, continues to issue debt. The financial ‘free’ markets enjoy their corporate welfare.

The fallacy of ‘taxpayers’ money has had profound consequences for society, enabling the sale of public assets to the private sector under the pretense of ‘TINA’ (‘There is No Alternative’) and recently the libertarian dream of freeports and charter cities. It shifted the responsibility of economic growth onto the financial sector, resulting in rapidly expanding private debt bubbles and financial crises, stifling economic demand and destroying lives. Financial deregulation has resulted in the concentration of wealth into a small cabal who pump vast sums of money into well-resourced think tanks, media, and of course political parties.

I would wager that several politicians understand this truth perfectly well, yet a departure from the narrative is likely to be career ending, and a lie is easy to perpetuate when your mortgage depends on it. It also allows the political establishment to abdicate responsibility for poorer societal outcomes. It results in the division and conquest of society and has us fighting amongst ourselves – “it’s all these folk on benefits”; “it’s the pesky Europeans”; “it’s the immigrants” etc. This is reinforced by a diet of TV ‘documentaries’ sensationalizing the lives of those on benefits, whilst the real ‘benefits street’ exists within a square mile in the City of London. Understandably, people have become disillusioned by the so-called ‘progressives’ who have chosen to cushion their career and jump on the Thatcher bandwagon. This is how we end up with right wing populists who promise to make it all better.

Sovereign currency issuing governments are the cash cow for financial markets – it’s not the other way around. Commercial banks are vital to any economy, but we need to understand that they are not the heroic free-market entities they are made out to be. It is far more accurate to describe them as public/private partnerships entirely dependent on the state. As such they need to be regulated to benefit society, not to loot it.

We have now reached a point where, by policy choice, our children and grandchildren face worse outcomes than us. Public institutions like health and education are being weakened and picked off one-by-one to the point where privatization becomes the ‘only option’. When considering what many would see as desired societal outcomes – first class health and education, cheap/free public transport, a zero-carbon future etc., the relevant question is not how do we pay for it, but how do we resource it? Sadly, that’s not a statement you’ll hear from any politician today.

The fundamental truth is that ALL money is effectively state money, without which there is no payments system, no banks, no economy, yet a very powerful lobby wants you to believe otherwise. If we are to have any meaningful future, it is up to all of us to set the record straight.

MY COMMENTS

I have several regular correspondents who contribute articles on economic and monetary matters. I appreciate that some readers will have difficulty understanding some of the points they are raising but I think this blog and our public understanding benefits for airing them regularly. One thing that always strikes me about these topics, where I claim little expertise is just how difficult it is to change conventional thinking which is clearly wrong on many factors and create gradual acceptance of alternative theories. This is a subject of great interest to me as it is exactly the same task that Salvo/Liberation face when it comes to the Constitution. The accepted narrative about the Union of the Crowns and the Treaty of Union are clearly completely false and we have an abundance of documented proof to show this but the scale of these lies and the longitivtiy of this gaslighting is on a scale that would delight Joseph Goebbels whose view was that if you want a lie to be successful make sure it’s a big one. So my thanks to Scott for his efforts and I hope readers are more open minded about topics after reading this article.

I am, as always

Yours for Scotland.

BEAT THE CENSORS

Sadly there are still some sites, fewer in number these days, who are intent in censoring posts from bloggers who do not slavishly follow the policies of one political party. They are opponents of the basic human right of Free Speech. Fortunately my readers can confound the censors by liking and sharing my articles as widely as they can. My sincere thanks to all that do.

FREE SUBSCRIPTIONS

The most reliable way to receive future articles from this site is to take out a free subscription and join the thousands who have already done so. They are available on both the Home and Blog pages of this site. You will be very welcome.

SALVO AND LIBERATION

Both these organisations are doing very valuable work and are carrying out very worthwhile research and building the International case to win our freedom. They are also leading the fight to expose the Freeport’s ruse as the latest method to plunder our country’s resources. Please join at Salvo.Scot and Liberation.Scot and if you can afford a donation that would be very gratefully received.Details are as follows

Bank RBS

ACCOUNT SALVOSCOT.LTD

Ac number 00779437

Sort Code 83-22-26

Anyone interested in the TRUTH about money should read The Defecit Myth by prof Stephanie Kelton or watch her on Youtube. She explains that the Government must SPEND then TAX. Not the other way around. They cannot collect tax to spend if they have not first created the Money.

Countries budgets are not the same as our Household Budgets

The Banks are not our friends!!

LikeLiked by 11 people

Great article thank you Scott and Iain.

I have argued this for years but people either don’t understand it ( money is complicated) or refuse to acknowledge it.

I have argued the point with a Chatrered Accountant who argued that it is all taxpayers money because income tax was created during the Napoleonic wars by Pitt the younger.

The problem is that people believe the ” big lie” made famous by Goebbels but espoused by Thatcher and all politicians since because it suits their explanation of why the poor are taxed more than the rich and helps reinforce the powerr of the elite.

more of the same please

Bill Fraser

LikeLiked by 11 people

A further point when this DEBT is mentionef adk one of two questions:-

To whom do we owe this money?

From whom did we borrow this money?

LikeLiked by 4 people

Where was the money spent?

LikeLiked by 3 people

And with who?

LikeLiked by 3 people

All mainly English projects.

LikeLiked by 4 people

Running the country of course

LikeLiked by 3 people

I’m glad you publish articles like this. I was aware of most of the points made from other reading but it’s helpful to have it in one place, benefits from several reads AND lots of people aren’t aware of it. I like Iain’s comparison to Salvo/Liberation. Challenging (wrong) orthodoxies is never easy even when you’ve the evidence to substantiate it.

Oftentimes even dedicated independence supporters say “we need a section 30 for indy to be legal”

I always ask “those law”. Why do they prioritise UK domestic law over international law? In the UK’s own submission to UN re Kosovo, the government made the point that the getting the existing states permission was unlikely and should be unnecessary as long as the choice was democratic and supported by the people of the area seeking independence. Turns out they meant “Not you Scotland!”

One very important point to take out of the article is the need for an independent Scotland to be a currency issuer. I think Salmond was wrong in 2014 to talk about keeping the pound, though I understand why he said it. The moment they publicly said no (whilst privately saying hell yes) is when that policy needed to be buried for good. No sterlingisation please. Scottish currency from the earliest it can be set up. Ideally on day one of independence.

LikeLiked by 10 people

A good article by Scott Edgar.

As somebody who graduated with a degree in Economics in 1982 I took great interest in what the politicians of the day had to say on the subject, particularly on ‘monetarism’ that was all the rage in Conservative circles in the early 80s.

The basic idea from Milton Friedman was that money supply could be controlled by government and, hence, price and wage inflation. Thatcher’s government tried this … and failed. The reason for the failure was that you couldn’t define ‘money’ even in those days as there were so many different ways of holding and, therefore, disguising wealth. Notes and coins, liquid current accounts, time-based deposits, mortgages, home loans held variously at accepting houses, finance houses, building societies, banks and, of course, ‘plastic’ money. So if you can’t define what it is how could you even hope to control the demand for, and supply of, ‘money’? It wasn’t possible and by 1983 the Tories had quietly abandoned money supply targets and, instead, used interest rates to regulate demand/borrowing/investment in the economy.

But the right-wing libertarians never abandoned the underlying target, namely to control people. Or, more precisely, people’s behaviour. Thatcher’s ‘Housewife Economics’ gave this away in later speeches when she said

“I can’t help reflecting that it’s taken a Government headed by a housewife with experience of running a family to balance the books for the first time in 20 years – with a little left over for a rainy day”

Ordinary folks were propagandised into feeling guilty about borrowing money, holding debt and receiving state benefits, all the while paying (much hated) taxes.

Thatcher’s government played on the ignorance around what taxes were used for and their lies were perpetrated by the right-wing British media. If you believed that public assets such as British Telecom, British Gas and the electricity boards were paid for by the public (or taxpayers) then, they argued, if you reduced taxes (the bribe) you could sell of the national assets to the highest bidder (right-wing libertarian corporations/friends of the Conservative government). As Scott says:

“The fallacy of ‘taxpayers’ money has had profound consequences for society, enabling the sale of public assets to the private sector under the pretense of ‘TINA’ (‘There is No Alternative’)”.

Money serves 3 basic functions in a society:

The first is as a medium of exchange. This facilitates both domestic transactions as well as external exchange (of imports and exports of both goods and services). Without currency we would revert to a system of barter which is hardly ideal and highly inefficient.

The second use of money is as a store of value. People put money away for a rainy day i.e. savings and for future purchases. Assuming that inflation is under control then money/currency is an effective means of maintaining a stock of liquid funds which can be easily accessed as and when necessary.

In addition money serves as a unit of account whereby the market value of goods and services can be valued and their relative worth compared.

But it originates from government via its central bank and is passed onto the commercial banks ‘open market operations’ and from there onwards to people and businesses.

That is the truth.

The rest is the lie that won’t die.

LikeLiked by 8 people

The LIE will die when we shine the light upon it. Everyone. needd to realise TAX is merely a means of controlling behaviour and it PAYS FOR NOTHING. We have these nutty politicians stating their policies are fully costed and they will increase tax on banks and big business! UTTER CLAPTRAP !!!!!

LikeLiked by 3 people

The fundamental TRUTH is that Scott is telling the truth and exposing the reality of political deceit that monetary and economic policies are only possible by the use of ‘Taxpayers Money’. This is the LIE.

This is why ‘Macroeconomics’ needs to be at the forefront of SALVO and Liberation Scotland’s educational forum along with ‘Scottish Constitutional’ and ‘Decolonisation’ history.

All ‘Self-financing Nation-States’, with their own sovereign currency, have the financial capacity to manage their economies for the well-being of its ‘People’. It is just a matter of ‘Policy’.

Thanks, Scott.

Neil🏴

LikeLiked by 13 people

The realisation that international finance effectively rules-the-roost in the capitalist West must raise some very serious questions for us all; particularly for our mainstream politicians who parrot illusory economic orthodoxies as incontrovertible truth. It will be those ultimately, powerless politicians and their captured parties who will be vying for our votes on July 4th.

LikeLiked by 7 people

I too am a “lapsed economist” and have just read The Deficit Myth by Stephanie Kelton mentioned above. I kinda understood modern monetary theory (MMT) before reading it but it really clarified things. Applying its principles to a newly independent Scotland is a game changer, and something the Scottish Currency Group is actively promoting. The single most key point is that our new state needs to be a currency issuer, not a vulnerable currency user of the £ Sterling or the Euro.

LikeLiked by 9 people

Bang on the button – and from day one.

LikeLiked by 4 people

Very well said Scott Edgar.

The whole ‘household budget’ and “Tax payers money” propaganda lie, as well as the cynical promotion of the monetarist dogma and theft of public assets by giving them away to a Financialised Elite was a deliberate and cynically executed ploy which lead to the impoverishment of ordinary citizens and enrichment of a tiny minority of the priviledged.

This is at the very heart of the system of Neoliberal Financialisation that people will have become aware of being introduced into the UK during the Thatcher / Reagan era and has now become accepted by the mainstream media as the current natural order – as if no alternative existed, or could conceptually exist.

In truth these are policy choices, and other choices could be made.

In parallel with the growing realisation that the creation and flow of money through the economy can and should be correctly accounted for by a modern fiscal accounting practices there has been a strong and growing movement developing especially since the Global Financial Crash that an alternative analytical framework is required to supercede much of current ‘mainstream’ thinking in ‘conventional’ economics.

Much of current ‘mainstream’ thinking in ‘conventional’ economics is similarly founded on assumption / opinion masquerading as fact.

Those interested could look up ‘heterodox economics’ on wikipedia.

So be aware,when you hear pronouncements from politicians or in the mainstream media, that often these originate from a particular ‘school’ of thought. Often from right wing neoliberal think tanks such as the Institute of Fiscal Studies or some Tufton Street ‘Think Tank’ (a polite name for a lobbying and influencing outfit).

These are not actually independent.

They adhere to a particular school of thought and allow only that the choices they would make under their world view are the only choices available.

This fodder fills the airwaves, but is often easily debunked, if you are aware of their idealogical biases.

A bit like English Exceptionalism really. In their ascendency they assume they have all the answers.

We know that English parliamentary Sovereignty is an alien concept in Scotts Law, and that King Charles of England has not sworn the oath which is required under our constitution to become the King in Scotland and is thus not the King of Scotland or the King of Scotts.

Knowing these simple facts, we are forearmed to point out the Falsehoods.

The Economic lies are similarly prevalent and emminently rebutteable, so educate yourselves citizens!

😉

LikeLiked by 3 people

Glad to see your comment eventually got through.

LikeLike

Scot has one T.

Economics is the study of gobbledegook by supposed Academics who need to confuse to seem important.

They are like accountants who know the cost of everything and the balue of nothing. Just saying!!!!

LikeLiked by 1 person

I am daily finding it harder to scream my outrage at the treatment of the Colony of Scotland.

The reason is not the many truths spoken in articles such as the one above.

My frustration is that a despicable collection of Troughers and Traitors within the ruling clique of the SNP snuffed out the momentum of 2014 and People still vote for them!

We will remain in limbo until the Enemy Within is destroyed. We are Howling in the Wind until True Leaders emerge who set out a clear cut plan which is truly assertive. A Plan which includes not taking seats at Westminster. Certainly not begging for permission to hold a Referendum.

Wake me up when those in the SNP actually want Independence.

Look at the Cretins seeking re-election to Westminster who do not have any passion for Independence. They have been bought/ensnared/seduced just as Rome controlled Lands captured by the Roman Empire by giving “Roman Citizenship” to those who ran their Outposts.

When the FM attends a Pride March instead of attending and speaking at the AUOB you know the fight is over. He boasts of his support for Trans Ideology in our Schools. He prefers the abomination of the Cult Flag to the Saltire.

The article is important but without the destruction of the SNP it will gain no traction.

We know all the things we have to fix………sending that scum back to Westminster will not do anything to address it.

LikeLiked by 2 people

Hi Iain, Great article on the UK money system. Just to let you know, I shared the link and someone replied informing me that the authors name is wrong. Scott’s surname is Egner not Edgar. Thanks again for posting the piece. Most Scots don’t yet recognise the importance of what Scott is writing about. All the best David.

Sent from my iPhone

>

LikeLiked by 1 person

That error was 100% mine. Changing now but more than a little late.

LikeLiked by 1 person

IF this is all a fallacy and misdirection to con and ensnare the public WHY is the former banker and former FM Alex Salmond so heralded and eulogised when he followed and would if elected continue to follow the same dogma when the TRUTH has been exposed as a lie

When independent If the article is the truth which I have no doubt is the case SURELY ALL publicly owned privately operated services and utilities can be taken back under public operation without any form of compensation to the current operators as they have benefitted greatly from this establishment CON

LikeLiked by 3 people

There is a tried-and-tested method by which ANY currency issuing government can nationalise ( or purchase ) ANY service or business while still being able to truthfully claim that there will not need to spend a single penny of ‘tax payers money’.

It has been known and used for many decades and the mechanism is completely unarguably available. And that is leaving aside the obvious option to ‘buy out’ at ‘market value’ when the ruined former national service like water or railways is in collapse and the purchase price ought to be £1. So when economists, think tankers or politicians deploy the ‘how will you pay for it ‘ gotcha they are oftentimes exposing that they are disengenuous deceivers. Of course they could be so ignorant or stupid that they have never looked for the available answer to the question that they they think they are being so smart in asking. Professor Murphy even made a short video about Bond Issues for Nationalisation recently: “Nationalisation does not cost taxpayers anything” https://www.taxresearch.org.uk/Blog/2024/06/16/nationalisation-does-not-cost-taxpayers-anything/ https://www.youtube.com/watch?v=eE1XN4IQyzULikeLiked by 1 person

Fiat money systems built on debt inevitably fail, the debt pile just becomes unmanageably big to service and a major reset is required , usually a war but the bankers have developed a new strategy thanks to the cashless society , CBDCs , Central bank digital currency. It’s coming and and it has been tried out in Nigeria of all places and Sunak has said we will have it in UK by 2030. Short taster on this here.

https://www.google.com/search?sca_esv=5f60c0af12b43c79&rlz=1C1MSIM_enGB731GB731&sxsrf=ADLYWIKDLx-tdJf6j2h2w5QfpytUAB-p1Q:1719404387161&q=dangers+of+cbdcs&tbm=vid&source=lnms&fbs=AEQNm0Aa4sjWe7Rqy32pFwRj0UkWd8nbOJfsBGGB5IQQO6L3J5MIFhvnvU242yFxzEEp3BeeRDeomFf8DkO7myIzvXpiBZLeK8lOOHkifHZCjMCSxhJreGmZcWppdd2A_2uqfKUXDLsbbtodTprZCiIGpEf7WBKrWG1Fk0TC4DyevdW0Zp-HCyVHhtAvXMBNpmSBrTpeYAUK&sa=X&ved=2ahUKEwjt-uK9oPmGAxVTTEEAHQlID8AQ0pQJegQICRAB&biw=1745&bih=835&dpr=1.1#fpstate=ive&vld=cid:0993c3e5,vid:6G-oKjxoy6Q,st:0

LikeLiked by 1 person

Utter Rubbish. Stick to dog trimming

LikeLike

This kind of analysis with echoes of Modern Monetary Theory worries me although I can see elements of truth in it. To me it always seems to assume that our economy and currency operate in isolation. In practice our currency is in competition with other currencies around the world and as a trading nation we debase our currency relative to others by creating too much of it at our peril. Simple economic theory never seems to take account of time constants. If you print money in excess everything seems fine in the short term before the rot sets in.

LikeLiked by 1 person

Money is not the problem. It is resources and goods which are the issue.

MMT is 100% TRUE if you take the time and have the intelligence to understant how money actually works.

LikeLike

Further Currency speculation will always happen and is Irrelevent to our currency paying for goods and services

LikeLike

Hi David. MMT is a just a description of how the economy works and having just completed a 12 week course in modern money and markets, I’d say it has a much more realistic view of how a nation relates to the rest of the world. In fact it is the economic mainstream and their neoclassical approach that still sticks to an antiquated story based on ‘comparative advantage’.

It’s a huge article in itself, but I’d recommend following Fadhel Kaboub. His focus is on the economic decolonisation of the African nations, and actually his work is very relevant to an independent Scotland.

LikeLiked by 2 people