The Self-Financing Nation-State and The Sovereign People

By Neil Tye.

Statement:

“Conclusively the falsification and obfuscation of the UK Unionist’s educational literature concerning Scotland’s valid Constitution is a deliberate malpractice : Additionally, then so too is their educational literature and media commentary concerning ‘Scotland’s Macroeconomic potential’ as an Independent Nation-State.”

Preamble:

This article, ‘Scotland – The Self-Financing Nation-State and The Sovereign People,’ suitably follows three recent YFS papers, two from Prof. Alf Baird concerning, (The Colonisation of Scotland’s Universities), and (Nationalise Clydeport) and one more recent paper by Mary MacCallum Sullivan (A New Story for Scotland). All these papers are important reads particularly when one considers their educational value, and economic implications for the Scottish Economy. The common denominator within these three papers is that rebuilding of Scottish Industrial infrastructure (The Economy) will never happen unless Scotland is ‘Fully Independent’ and has the power to monetarise its own government’s expenditure. Therefore, education is incredibly important, and this paper provides that knowledge and consequently, proposes very progressive and practical solutions that need to be considered and addressed regarding the:-

The power of ‘Scottish Peoples Sovereignty‘ over and above ‘Party Politics.’

Introduction:

This paper encompasses two powerful interconnected themes surrounding the singular development of the new ‘Nation-State of Scotland’:

These two themes are: –

- ‘Scotland – The Self-financing Nation-State’ – The power of our own currency:

- ‘Scotland – The Sovereign People’ – The power of a People-Centric Community:

Theme 1. ‘Scotland – The Self-financing Nation-State’: describes the Government’s public sector mechanisms and protocols of a future independent Scottish Parliament and its legislative powers. The key body is the Treasury and Exchequer department linked directly to its Scottish Central Bank (SCB), with its own currency, and the wider Government Banking Service. These are the entities within a ‘Scottish Accounting Model’ that will drive the economy with its own governmental expenditure and revenue collection programme.

All expenditure will arise based on permanent or annually voted authorisation from the Scottish Parliament and the SCB will be legally obligated to issue the approved ‘Credit’ directly from the government’s ‘Consolidated Fund Account at the SCB to the Treasury Central Funds, namely the Consolidate Fund (CF).

Central to this legal process is the consequential effects that only government expenditure into the economy, from the public purse, can deliver the necessary funding capable restructuring and rebuilding of our Scottish economy and infrastructure. This would purposefully include the new construction and fully upgrading our shipping ports through direct government finance and management capable of delivering and receiving our international exports and imports. This will provide greater inhouse production (employment), and greater national wealth increasing the economic Gross Domestic Product (GDP). Freeports will not provide these developments, only corporate profit.

The ideal financial model, for an independent Scottish government, could be a replicated bespokeversion of the UK Government’s financial and legislative administration which is the oldest surviving institution of its type in the world with the key legislation being formed in the mid-19th century. As a financial institution, it has been copied by several politically independent nations, and thus for Scotland it is a fascinating proposition that would pave the road for Scotland as a ‘Self-Financing Nation-State’ with our own Scottish independent administration. It certainly merits attention for its resilience and the relative economic success it has bequeathed the UK for more than 237 years.

Theme 2: ‘Scotland – The Sovereignty of the People’ describes the pivotal founding principles in the building of our independent Nation-State that is constitutionally managed as a bicameral Parliament (two distinct chambers). This parliamentary arrangement would be similar to the Swiss Federal system but with specific differences in that the power of the first chamber, (The People’s Chamber 1 would be ‘Sovereign’ and constitutionally superior to the political second chamber (Political Party’s Chamber 2).

The reality of our Scottish constitutional history validates this notion and transforms this philosophical principle as a practical translation of sovereignty into rights and duties of the people within Parliament and our nation’s territorial borders and legal maritime limits.

With these principles in mind, it is time to question and deliver suitable resolutions because without these principles, such an entity has no existential legitimacy, and any development or theory must embrace these conditions unconditionally, consolidating the value of unity into, a ‘Citizenship with Collective Authority,’ over all other entities.

This political and governmental framework would reconstitute the valuable and meaningful status of ‘Democratic Governance’ that functions as a united entity for the people in contrast to our current singular parliamentary framework of ‘Party Politics’ only divides us.” The objective here must be to eliminate the potential economic risk of institutional corruption infesting our new ‘Parliamentary System’ that is so evident at the Westminster Parliament and the current Holyrood Parliament. Political corruption is a deviation from the rational-legal moral values of a modern state, and the basic problem is the weak accountability between the governors and the governed.

The current formal legal framework is therefore insufficient as terms of reference to assess and judge the problem of corruption. Moral, normative, ethical, and indeed political benchmarks will have to be brought in to bare-down and erase the problem.

The operations of the ‘UK Exchequer and Treasury Accounting Model :

(A Scottish bespoke replication for a Self-Financing Government):

The main contention of a new comprehensive six-year research study, concerning the accounting model of the UK Exchequer and Treasury, is that the source of UK ‘moneyness’ (credit) emanates from within the UK Government’s own central accounting unit, ‘The Consolidated Fund Account.’ It was established in 1787 and is now controlled by HM Treasury and is the primary account for the UK Government at the Bank of England (BoE). It is administered by the ‘Exchequer Funds and Accounts Team’ (EFA) department, not the Bank of England, as commonly believed.

“At the heart of the UK Government’s spending mechanism is its Consolidated Fund Account. This is best understood as a line of sovereign credit that the government, via permission from Parliament, draws on, backed solely by the ability to raise taxes in the future”: – A. Prof. Josh Ryan-Collins (UCL) 2022:

“Your Taxes do not pay for UK Government Expenditure”

This new co-operative research study has been academically approved and verified by the University College of London (UCL) and thereafter discussed with the Bank of England (BoE). It is currently under evaluation by academic publications for international distribution.

Economically, it supports the ‘Chartalism‘ theory of ‘money’ proposed by German economist, Georg Knapp, in his 1905 paper, ‘The State Theory of Money’. This Chartalist viewpoint principally defines ‘Money’ as an abstract and unlimited unit of account defined and issued by a central authority, (in modern times, the UK State).

The clarification of this new knowledge exposes the impurities in academic literature and focuses on elaborating the missing links of mainstream political theory. It completes and rewrites the total synthesis of previously published and unpublished information, being the first fully detailed institutional analysis of the UK Government’s expenditure, debt issuance and revenue collection processes that have always been incomplete and never updated since 1985.

This omission is positively damning, but this new study goes further and notes that many of the macroeconomic mathematical accounting models, conceptualised by academia, politicians, and media, are contrary to the actual functions of the economic processes that are actually enshrined by the legal regulations and Acts of UK Parliament.

Bizarrely or purposely, it is also currently absent from academic literature within the economics profession itself. One would have thought that somebody should have questioned this omission and asked why they have not bothered to conduct their own study in the interests of public education!

What this document implies is that UK Parliament has supreme authority over government spending and individual departments cannot spend autonomously, without parliamentary prior authorisation. In this way, UK Parliament effectively votes and legislates money into existence.

Firstly, the UK Government conclusively manages the UK economy as a ‘Self-Financing’ entity and the legislation in place has been functioning for 158 years. The sample-part shown below, is the UK Government’s most important historical and current principal legislative ‘Act’.

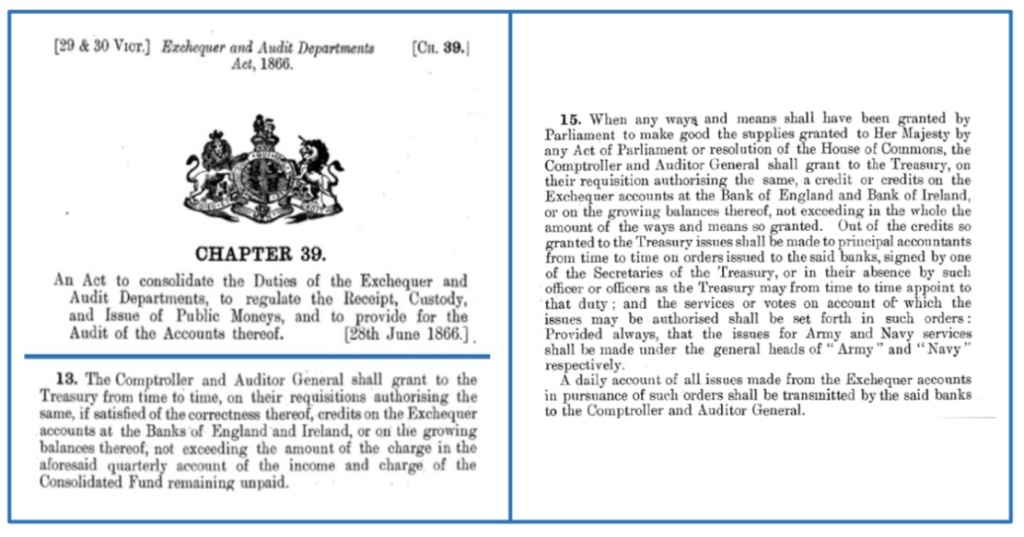

It is known as the ‘Exchequer and Audit Departments Act 1866’

The important Sections 13, and 15 below, relate specifically to ‘Permanent Services’ and ‘Annual Supply Services’, respectively for all government departments. It is the legal procedural requisition mechanism of financial credit, as ‘Public Money. It legally affirms and constitutes the flow of financial ‘Credit’ to be appropriated from the BoE to the UK Treasury Fund without any exogenous conditions. This source of money for government expenditure is unequivocally approved by Parliament via its Supply votes.

Furthermore, the Treasury will then order the BoE to issue credit to the principal Department Accounts for spending into the UK economy.

The HM Treasury is the sole shareholder of the BoE and as such retains a public interest and the power to appoint and give authoritative direction to the ‘Governor and Monetary Policy Committee’ of the Bank, when necessary.

Since 1946, and subsequent Acts in 1998, 2008 and 2016, the Bank is not independent of UK Government and has only delegated responsibility for conducting ‘Monetary Policy’.

Secondly, within the UK, the Government supports the management of the entire UK monetary system, and the UK Government is only subject to the will of Parliament, not any external financial resource constraints, as often purported.

The process is legally mandated and cannot be challenged by the BoE or any other government department. The BoE has no power to refuse and there is no legal mechanism by which a balance must be checked for available funds. The BoE must comply to the Treasury’s orders. It should also be made clear that when the UK Government spends newly issued money into the economy, it destroys money when it taxes.

“There is no such thing as ‘Taxpayers Money’ – All money is ‘Government Money”

This is contrary to general mainstream debate and media rhetoric that all government expenditure is funded by taxation or borrowing from the private sector. The reality is that it is the reverse case, taxation is a consequence of government spending. In fact, all UK Tax revenues flow through to the Exchequer HM Treasury, Government Banking Service (GBS) accounts and deposited in the ‘HMRC Revenue Account’ at the Bank of England.

Thus, within the framework of UK Parliamentary and Government protocols the UK government’s budget expenditure does not maintain specific balances from which expenditure is sourced. Logically therefore, expenditure is not constrained financially.

Conversely, taxation and other receipts provide the crucial ledger function of offsetting the effect of government spending upon the circulation of money and demand for real resources within the economy.

The study would be a suitable benchmark for a future independent Scottish Nation-State.

Theme 1. – Scotland – The Self-Financing Nation-State

The power of one’s own currency:

It is commonly and erroneously claimed, by antagonists of Scottish Independence, that a future independent Scottish government with its own fiat currency will be unable to finance its own economy with sufficient funds and therefore subject its economy and the population to huge public and private debt, or worse, bankruptcy and hyperinflation, because the only logical source of funds would be obtained through expensive borrowing from financial lenders.

This hostile nonsense, directed towards the hypothecated theory of self-monetary financing, uses false rhetoric, orchestrated by mainstream economists and commentators for the purpose of deception. It was also fuelled by the issuance of the Maastricht Treaty in 1992 by the EU that focused on the EURO-centric ‘Currency Union’, a separate Independent Bank, and fixed monetary growth rates. Many nations preferred to remain outside these financial controls by maintaining their own currency controls. It is a system that will eventually fail because individual EU nations are financially constrained.

This article will hopefully dispel some latent historical fears that have been festering in society for over 53 years caused by ‘Thatcher’s Pandora Box’ of evils, political propaganda, and commentary falsehoods that have endured and deliberately undermined the reality of government finance for the UK, and the shackled economy of Scotland.

Also, it does not define, describe, or support any particular ‘Economic or Political ideology,’ but more precisely describes and offers a view through a ‘Looking Glass’ into the ‘Realities and Actualities’ of how most Sovereign Independent Nation’s financial systems, protocols, and mechanisms operate, by utilizing their own fiat currency.

The following paragraphs describe and graphically detail a proposal for a future Scottish Government’s ‘Accounting Base-Model’ that effectively could, with all the necessary Parliamentary protocols, enable the Scottish Treasury and Exchequer department to financially service and manage our own economy.

In fact, as the recent ‘Accounting Model’ study of the UK Government’s self-financing ability has demonstrated then, so too will a Scottish Government be able to replicate a similar model within its monetary system. This includes the creation and issuance of monetary instruments and guarantees that are approved through legislated protocols by Parliamentary votes. This will underpin the whole public and private monetary framework of the Scottish economy.

However, the most important caveat, as shown in the graphic below is the inclusion of a Scottish Parliamentary Bicameral system.

This Bicameral Parliament would provide and encompass the additional entity of ‘Sovereignty’ into the parliamentary structure, based purely in the hands of the ‘People’. The UK parliament has sovereignty in Westminster, but Holyrood is void of sovereignty.

It is the best option to ensure that there is a regulatory and authoritarian body that could enforce political levels of policy approval and political accountability within the Scottish Parliamentary system. This needs to be in place in order to eliminate the damaging effects of autocratic leadership and their cabals. This reflects recent events with respect to the SNP political party debacle, financial expenditure misappropriation and infrastructure policy errors, not mention corruption at both Holyrood and Westminster.

Political and Corporate corruption that is one of greatest challenges of the contemporary world. It undermines good government, fundamentally distorts public policy, leads to misallocation of resources, harms the private sector, its development, and vulnerable people.

The Scottish government’s process of financing the economy will be the responsibility of Scottish Treasury and Exchequer department which will sit at the head of the government’s administration. It will have the responsibility of steering the process that will govern public expenditure into the government’s Consolidated Fund Account and eventually the future revenues of taxation that flow back into the Scottish Revenue Account.

The role of Scotland’s Parliament will be broadly one of governance within the finance system. It will be shown that a Scottish Treasury (Government) does not have to seek, retain, or accumulate surplus revenues to spend. The source of (credit) money for the Scottish government expenditure will be unequivocally approved by the Scottish Independent Parliament via its supply votes and the legislative Acts of the Scottish Parliament and legislature.

The reality and value of how the mechanics of government economics functions and able to deliver good social outcomes has an overwhelming importance to the overall well-being of the Scottish economy. Additionally, this knowledge would be instrumental as an educational tool for our own ‘SALVO – Liberation Movement’ and other dormant advocates of Scottish Independence.

This knowledge will empower our people and add strength to their arguments countering false political rhetoric and complicit supportive mainstream media misconceptions with respect to the realities of financial economic potential.

Theme 2. ‘Scotland – The Sovereign People’ – The power of a people-centric community:

It is time for thoughtful consideration and applicable change within the confines of Scottish Politics and the ‘Peoples’ position within society. The need for change in the position of the people, from mere objects of the governments to people who see themselves as subjects and owners of their sovereignty. That ownership brings tangible responsibilities that must be grasped, earnestly.

The Scottish Parliamentary system detailed graphically above would accommodate two separate chambers: ‘The Sovereign Peoples Chamber 1’ (Apolitical) and The Political Party’s Chamber 2 (Political). This constitutionally correct arrangement is akin to the Swiss Federal (Sovereign People) regional (cantons) model.

As of now, our Scottish Parliament is complicit in maintaining a subordinate ideological relationship with a corrupt Westminster government which has a ‘state-centric sovereignty’ perspective. That authority and the policy power will always remain with the UK state until rebellion alters the course of history for the better.

What exacerbates our people’s inability for democratic change is that politicians argue that our democratic rights are permanently available to us every four or five years as electors. Within those four or five years our democratic rights vanish, and all politicians become unaccountable. The people therefore become the vassals of the state, not the recipients.

As long as citizens take a ‘wait and see’ position, the nation-state of Scotland will end in a self-fulfilling prophecy of failure. We need education and an active engagement of our communities by the ‘sovereign people’ to build our own society. Our government and its institutions alone will not win this uphill battle.

Sovereignty of the People creates Unity : Party Politics creates Division

MY COMMENTS

Neil highlights the great problem of Party Politics…it is built on division and leads to rancour much more often than cooperation. It is a great weakness, not just in economic terms, but also in achieving the Independence our nation desperately requires. I welcome this type of article because it indicates vision and ambition. Two vital ingredients in short supply sadly within Scottish politics at the moment. As a country we used to be admired worldwide for our invention, education, productivity and industry. Our obvious colonial status these days is detrimental in effect. It is time we raised our game.

I am, as always

YOURS FOR SCOTLAND.

BEAT THE CENSORS

Unfortunately there are some sites where extensive blocking takes place against bloggers who do not slavishly follow the dictates of one political party. This is a direct threat to freedom of speech and I unhesitatingly condemn such action. To overcome this problem I rely on my readers to share Yours for Scotland articles as widely as possible. My thanks to those who help overcome censorship.

FREE SUBSCRIPTIONS

The most reliable way to get articles from this site is by taking out a free subscription which are available on the Home and Blog pages of the Yours for Scotland website. Given that I often seem to face other problems with both Twitter and Facebook this guarantees that my content is freely available.

SALVO

Salvo continues to do valuable work and an ever increasing number of people are involved. They are now running strong campaigns on several key issues and as the campaigning arm of Liberation.Scot they are the key to success. If you would like to make a donation to further Salvo and Liberation’s campaigning here are the details. All donations large or small greatly helps our work.

Bank RBS

ACCOUNT SALVOSCOT Ltd.

Ac number 00779437

Sort Code 83-22-26

LIBERATION.SCOT

If you have not already joined please visit the above website and join now. We are looking to achieve a membership larger than any other political organisation in Scotland to approach the UN to achieve the official status as Scotland’s Liberation Movement intent of removing the colonising forces from our nation. Be part of it.

Phew!! My thanks to Neil for this paper that I have no doubt will become a central pillar of reference for the kind of independent Scotland we envisage. I won’t pretend to understand all of the technical and financial information within the article but do understand the broad concepts (after a second reading).

Currently, our politicians, apart from one or two exceptions, appear to believe that cloning what the Westminster government has in place politically is what the people want to see because that’s all they have ever known. That’s what scares politicians so much about Direct Democracy and the work of Salvo / Liberation.

Working for several months with Henry Ferguson (a Scot living in Switzerland) has given me a fair understanding of how Direct Democracy can work for the people of a nation-state.

The citizens of Switzerland are termed “The Sovereign” with ultimate authority and while that has resulted in a few referendums and initiatives every year, they have a people who are very much more aware of, and involved in, the governance of their nation. This produces a more informed and politically astute population.

Another huge benefit that Henry described to me on a number of occasions is that politics in Switzerland is consensual and not as we have here at both Westminster and Holyrood – confrontational, with political parties enacting their own particular ideologies. Politicians in Switzerland understand that the people are sovereign and therefore the policies and legislation that they propose are less extreme, because they can be challenged by The Sovereign.

My discussions with a large number of people from different backgrounds and different areas of Scotland over the past year regarding the introduction of Direct Democracy to replace the Parliamentary Democracy we have suffered for centuries, has had an almost unanimously positive reception.

I have mentioned this before, but when on my local High Street a few months ago one of the women in a group across the street, called me to come over and help her explain Direct Democracy to her friends. Everything I said was positively received until one of them asked me – “Ah, but would the politicians let you do that!” When I laughed, she said – “Oh, I see what you mean”.

Thanks again to Neil for producing such an important article.

LikeLiked by 11 people

I recognise some might find some of this paper heavy going but it deals with heavy and important subject matter and the more that can and do understand these issues the more likely better outcomes can be secured.

LikeLiked by 5 people

An excellent contribution. But It is essential to remember that within the economic con-job imposed on Scotland, many-a-pocket has been well-lined amongst the permanent quangocracy: a cancerous little group of well-connected, institutionalized spivs ultimately, who will resist all reform. Major surgery will be required.

LikeLiked by 15 people

Interesting stuff. Most don’t need the technical detail but it’s needed for the “cannae dae that” brigade.

I’ve a couple of (daft wee lassie) questions.

Finally thanks to Neil and all the others working so hard to put together the information needed to take us forward into independence. Pity the so called pro indy government thinks a couple fo pages of management speak/guff suffices though!

LikeLiked by 9 people

https://new-wayland.com/blog/the-only-bonds-we-need-are-granny-bonds/

3. The National investment bank is just plain vanilla ” deficit spending “

https://neweconomicperspectives.org/2015/09/corbynomics-101-its-the-deficit-stupid.html

THE common weal didn’t understand what they were dealing with as they didn’t look at the accounting.

LikeLike

“The National investment bank is just plain vanilla ” deficit spending”

In accountancy yes.

However in policy terms it’s a government directing investment into under developed regions/industries where private funding isn’t available and/or where you seek to redress decades of industrial underinvestment (as has happened in asset stripped colonial Scotland). They idea, of course, is to increase productivity, compensate for years of underfunding, provide high quality jobs and ensure the economy works for the people, not the globalists and 1%. Basically Keynesian economics in a nutshell.

LikeLiked by 4 people

How will the People’s Chamber be selected?

Crucial question imho and the extent of its powers? And worthy of a follow up discussion/debate.

LikeLiked by 12 people

Meant to add – the same question arises in discussions over a Constitutional Convention, most often characterised as MPs and MSPs in the forefront and something loosely described as “civic” tagged on at the rear of a list.

LikeLiked by 8 people

Agreed Mike. Can you imagine the frenzy and nepotism and double dealing behind the scenes to get on it.

Then clearing out the civil service to make sure it does whit its telt.

LikeLiked by 7 people

Which is the definition of ” deficit spending “

You don’t need an investment bank – period.

Just targeted deficit spending investment by the government does the exact same job. As you can see an investment bank can be corrupted.

LikeLiked by 2 people

Under the parliament section, would the People’s Chamber have the right to veto any/all of the legislation of the Politician’s chamber? Or could they at least call for referendums if a subject is deemed contentious or not in line with public wishes?

Basically I’d like to avoid a GRRB type scenario. Section 35* saved us then but what would save us in an independent country? Asking for the women of the country, many of whom have gone off independence because they worry about a Green/SNP government with full powers and what they might do! Yes I know they wouldn’t necessarily be the government but the other parties (Alba, ISP and Tories excepted) are on board too.

*Another contentious bill coming forward on “conversion practises” viewed by many as every bit as dangerous.

LikeLiked by 4 people

Something close to the Swiss system is the answer. It keeps the people sovereign at all times including the period between elections

LikeLiked by 10 people

As someone who did a crash course Higher in the subject of Economics in my last year at school in the late 1970s before going on to obtain a BA degree in the discipline I continue to find it absolutely astonishing that this subject is still not mandatory in Scottish schools.

Arguments about ‘Economics’ have essentially decided British General Elections for at least the last 50 years. Everybody has an opinion about ‘Economics’ . Yet few understand even the basics, due to lack of education and misrepresentation/misinformation (by politicians, journalists etc) in equal measure. This suits the political class just fine as they try to con their way into power for another x year slurping and troughing at our expense while the media talk at us reminding us of our lowly place.

Neil Tye is, therefore, correct. In a future independent Scotland we need to have citizen involvement. People need to engage and be engaged with our politics and economics in order to minimise corruption and to give effect to the social outcomes that we wish to see.

Nobody said it would be easy!

LikeLiked by 16 people

Economics – “find it absolutely astonishing that this subject is still not mandatory in Scottish schools”.

Along with so much else that should be mandatory. We can’t have our children smarter and more informed than we are!

Children have been under the cosh of “educationalists” for decades who all know better than parents what is needed for their children’s education. Going back to the early 1970’s when phonetic alphabets and Cuisenaire Rods were essential to teach English and Maths and the child psychology of Piaget – remember them?.

It is of course important to teach what children will need in a fast-changing world,. However, I feel that it is most important is to have an understanding of who you are and where you came from. A person’s rights and obligations and especially their Human Rights, is also an essential element in the curriculum to help build a more tolerant society, and oh boy do we need our independent nation to be different from the greed and selfishness that was the central pillar of Thatcherism and the intolerance that it was built upon.

A return to the Common Good, about which I have found our children know little or nothing, must be one of the major founding principles of our Constitution.

LikeLiked by 11 people

As a Support for Learning teacher I quite liked having access to Cuisenaire rods. Half the problem with kids who ‘don’t get’ basic number bonds or multiplication and division is that concrete materials are dispensed with far too quickly.

LikeLiked by 3 people

Agreed Duncanio. Your point about education with regard to economics and its systems will also be fundamental to avoid the ideologies and misinformation by politicians and other ideologues.

it should be a required subject in our schools along with maths, languages, history ( written by scots) and the sciences.

Great article from Neil Tye. Needs a re-read by myself and probably for many but very clear description of the processes.

LikeLiked by 10 people

Hi Linaryg I agree that Cuisenaire Rods do work for some children ‘who don’t get basic number bonds’ and others who rely on visual aids but for the majority they confuse the learning process and over-complicate.

I suppose I was fortunate as I seem to have an aptitude for numbers – other branches of mathematics, not so much – in fact not at all.

LikeLiked by 1 person

I was thinking with my S f L hat on rather than my primary teacher hat it’s just a bit of a bee in my bonnet the speed that concrete materials are dispensed with for all children regardless of whether they still benefit from them or not. We all initially need them to make sense of numbers whether it’s one to one matching with cups and saucers, sitting on the carpet at granny’s, unaware we’re learning to count in 2’s and sowing great foundations for the 2x table or surreptitiously counting with our fingers or later using tally marks.

unfortunately only a very small percentage have an aptitude for numbers and luckily only a very tiny percentage find numbers such a difficulty that they are dyscalculic.

One size doesn’t fit all and for educationalists far removed from the classroom to assume one bought in material will be a panacea is of course misguided.

Now don’t get me started on fostering pre reading skills in nursery. That’s based on sound theory 40 years old now and still hasn’t filtered through to inform the education of early years workers.

LikeLiked by 2 people

Excellent !

A very well written piece bravo !

Now you just have to come to terms with the job guarentee and how that is a central piece of this architecture. The keystone of it all that anchors prices and is a fantastic automatic stabilizer and replaces interest rate targeting and ensures an independent Scotland doesn’t need to issue any debt – Scottish government bonds.

Come to terms with trade and there is no Sophies choice between the EU and EFTA that seems to be have been forced upon us for some strange reason. We can actually choose our own path trading in WTO terms.

That’s all you are missing now that you have the most important part right.

Let me give you something concrete then. We can buy the unemployed at £10 per hour – permanently. Without touching taxation rates. That will automatically stabilise the economy as it stands.

https://new-wayland.com/blog/how-the-jg-controls-inflation/

THE only bonds we need are Granny bonds

https://new-wayland.com/blog/the-only-bonds-we-need-are-granny-bonds/

The issue the monetarists suffer from is an aggregation issue. If you hold £100, nobody knows if you are saving that or intending to spend it. What we really need is the amount of bank liabilities that have materially changed their ownership tag over a period of time. Then we

would know what ‘Vt’ is. But we don’t have that, so monetarists try to guess – assuming all M is in motion if it fits in a particular classification. Hence all the M1, M2 nonsense. Those categorisations

are wrong. Plain and simple. As we can never know what ‘ Vt’ is.

I don’t have to spend a demand deposit. It can sit there for months. I don’t even need to ‘optimise’ it, because unlike economists my life doesn’t revolve around a belief in interest rates ruling everything. I just keep it there because I like the size of it, or I’m scared of the future. Or a bit of both.

The neoliberals and conservatives say nothing very much – other than lamenting that they can’t work out what money is locked in place and which is in circulation because we now have interest payments on demand deposits and time deposits that can be cashed on demand.

The monetarists are stuck in the 1960s. Finance has evolved so that nothing is locked in place – which means you can’t manipulate it to speed up and slow down the economy.

Instead we need to leave the market for money to private sector to sort out, much as we do the market for tomatoes, and shift the stabilisation policy to the market for labour – where we can do

something to speed up and slow down the economy.

The Job Guarantee.

Monetarism is a busted flush due to financial liquidity innovation.

You are 3 steps away from officially becoming a MMT’r like myself.

Putting it altogether whilst choosing a domestic consumption trade policy looks something like this.

https://new-wayland.com/blog/running-a-modern-money-economy/

LikeLiked by 2 people

Vt Derek?

LikeLike

As the conversation relates to the MMT – Modern Monetary Theory – I would imagine it refers to the “velocity of money” i.e. the frequency with which a unit of money is spent across all transactions (or the number of times the money stock is circulated in the economy in a specified period of time e.g. 1 year).

It is one of the 4 components making up the Quantity Theory of Money from Classical (macro) Economics which is based on the “Equation of Exchange” first formulated by Irving Fisher (1911) which holds that:

Mt * Vt = Pt * Yt

where

Mt is the money supply,

Pt is the general (aggregate) price level

Yt is national output (or GDP)

Monetarists like Milton Friedman (1970s/80s) assumed that the velocity of money (Vt) was stable and that as the economy veered towards full employment/maximum output (Yt) any increase money supply would feed directly through to an increase in prices (Pt) and, hence, to inflation.

You did ask!

LikeLiked by 3 people

Yup Duncanio describes it perfectly.

In layman terms

Here:

https://realprogressives.org/money-growth-does-not-cause-inflation/

LikeLiked by 1 person

Excellent article! The internet is full of how an independent Scotland might be.

What is almost impossible to find are proposals to get from our present position to statehood.

To do that one has to have proposals to dissolve the Union but as important a proven way to have the public funds to meet al social security and state pension and public sector salaries in the event that the uK government won’t cooperate.

We live in a sort of welfare state where people are dependent on these benefits so they’ll not vote for an independent Scotland unless they know that their benefits will be paid even if the U.K. won’t play ball.

Until we address that point then those who are sympathetic to Independence will not vote for it due to their personal financial uncertainty.

G

LikeLiked by 10 people

Project Fear targeted elderly and disabled people very successfully with their lies and misrepresentations of how Scotland could possibly pay benefits and pensions at the rates they were receiving. The timing made it difficult to respond to those lies and they had a tremendously negative impact on the result.

Even now, with the worst public pensions in Western Europe and disability support that is nowhere close to what is required for disabled people to participate in society, many still worry about what those lies told them 10 years ago. However, next time we will be more prepared to counter the inevitable Project Fear2. It doesn’t need to resurrected because it has just carried on after 2014.

LikeLiked by 5 people

https://unchained.com/blog/enders-game/?ref=tftc.io

…Fiat currency / Central Bank / State theft via inflation. – never a good combination

An Independent Scotland based on a hard, decentralised currency is a huge opportunity and a base for a new renaissance.

Cheers

Govinda

LikeLiked by 3 people

Thanks Duncanio. I did ask!

Another for me to read several times. Lol.

LikeLiked by 3 people

I find this article interesting as well as the comments above. The diagram is clear. Within each discipline there will need to be rules obviously. I hope these are not a copy and paste from what we have now.

I like the idea immensely that politicians are not sovereign. Our tossers on the current gravy train will have a heart attack if they read this. Mind it’s maybe too hard from them. I suspect words like honesty, integrity, grit and determination may be lacking,

LikeLiked by 6 people

This will help Duncan it is excellent

https://realprogressives.org/money-growth-does-not-cause-inflation

THE assumptions they apply to MV= PY are wrong.

M: That which is money is easily defined and identified and only the central bank can affect its supply, which it can do with autonomy and precision.

V: The velocity of money is related to people’s habits and the structure of the financial system. It is, therefore, relatively constant.

P: The economy is so competitive that neither firms nor workers are free to change what they charge for their goods and services without there having been a change in the underlying forces driving supply and demand in their market.

y: The economy automatically tends towards full employment and thus y (the existing volume of goods and services) is as large as it can be at any given moment (although it grows over time).

THE Truth

M: A precise definition and identification of money is elusive in a modern, credit-money economy, and its volume can change either with or without direct central bank intervention. In addition, the monetary authority cannot raise the supply of money without the cooperation of the private sector. Because central banks almost always target interest rates (the price of holding cash) rather than the quantity of money, they tend to simply accommodate demands from banks. When private banks communicate that they need more reserves for loans and offer government debt to the Fed, the Fed buys it. It’s the private sector that is in the driver’s seat in this respect, not the central bank. The central bank’s impact is indirect and heavily dependent on what the rest of the economy is willing to do (which is, incidentally, why all the QE and QE II money is just sitting in bank vaults).

V: The velocity of money is, indeed, related to people’s behavior and the structure of the financial system, but there are discernable patterns. It is not constant even over the short run.

P: While it is true that factors like production bottlenecks can be a source of price movements, the economy is not so competitive that there are not firms or workers who find themselves able to manipulate the prices and wages they charge. The most important inflationary episode in recent history was the direct result of a cartel, i.e., OPEC, flexing its muscle. Asset price bubbles can also cause price increases (as they are now). The key here, however, is that P CAN be the initiating factor– in fact, it has to be, since M can’t.

y: The economy can and does come to rest at less than full employment. Hence, while it is possible for y to be at its maximum, it most certainly does not have to be.

SUMMARY:

The bottom line is that the “money growth==>inflation” view makes perfect sense in some alternate universe where all those assumptions regarding the variables DO hold, but not here, not today, not in the real world.

Remember that Friedman used a helicopter to drop money on everybody –indeed, he had to, for there was no other way to make his example work.

LikeLiked by 2 people

As part of my undergraduate Economics degree in 1982 I completed a dissertation called “The Behaviour of Sterling M3 (£M3): Lessons for Monetarists”.

The main conclusion was that ‘money’ could not be defined even in those simpler days as how people held their wealth (for transactions purposes) evolved and changed chameleon-like as governments tried to control the stock of money.

So if you can’t define the target you can’t control it.

My tutor Professor Donald Mackay (@ Heriot-Watt University) agreed as seemingly did the British Government (under Thatcher) shortly afterwards:

In order to effect demand for money – and, thus, price inflation – the government could opt to use either money supply control or interest rate targets. Not both

They chose the interest rate levels – thereby implicitly abandoning control of money supply – as their monetary policy tool.

LikeLiked by 3 people

Exactly Duncan !

They chose the interest rate levels and it doesn’t work. They have the whole thing backwards.

The Eurozone and Japan had zero and negative interest rates for decades and could never hit their 2% inflation targets. They always ended up below it. So cutting interest rates don’t cause inflation.

During the supply side constraints hiking rates didn’t make boats, trains or lorries move faster it just increased the price of credit on all goods and services that were then passed onto the consumer. Increased interest payments to the economy. Welfare for those that have money.

They have it all backwards. Interest rate targeting is the devil. It is unethical and immoral to deliberately try and make people unemployed just to control inflation. It is amazing they get away with it.

The job guarentee does a far better job as both a price anchor and an automatic stabiliser. Keeps everyone employed on a living wage. Rather than the carpet bombing approach of interest rate targeting.

The BOE has missed its inflation target 107 times in the last 180 months. How much longer before we accept changing the base rate doesn’t work?

LikeLiked by 1 person

The interest price spiral

https://new-wayland.com/blog/interest-price-spiral/

The Perpetual Problem With Interest Rates

https://new-wayland.com/blog/the-perpetual-problem-with-interest-rates/

LikeLike

There’s been a lot of talk about pensions in the thread which is good as people are starting to think about it. We solved it in the link I posted above – The only bonds we need are Granny bonds. It gets to the crux of the issue.

You see, once you understand what Neil has laid out then pensions are NOT an affordability issue. They are a PRODUCTIVITY story. So what do I actually mean when I say a PRODUCTIVITY story ?

If you are a member of a pension scheme then the savings of the current generation, plus the interest on Gilts and any income from the other assets owed pay the pensions of the current generation of pensioners. They are all, in effect, private taxation schemes that circulate money around the system.

You’ll note that when there was a threat of people failing to save in pensions, the government introduced compulsory retirement saving – which is of course a privatised hypothecated tax.

So in essence rather than the assets of a pension scheme being used to purchase Gilts, the assets would be used to purchase an annuity from the government dedicated to an individual. The result is that rather than the private pension receiving Gilt income from the state, to then pass onto the pensioner, the state would cut out the middleman (and their cut) and pay the pensioner directly as an addition to the state pension.

The working population has to be productive enough to supply the goods and services that everybody needs. That includes workers and the retired. If we are not productive enough then a battle happens over the goods and services we produce between those working and those retired which drives prices up.

Why we end up working longer and our pensions never go up but the age we retire at does. They lie and say it is an affordability issue when the truth is they want to take the spending power away from people who are retired.

Productivity is key. The more productive we are we could retire at 55 and get paid bigger state pensions. The Job Guarantee drives productivity forward as it makes capital compete for Labour for the first time in 50 years.

Free movement of people destroys our productivity – another reason why not to be a member of EFTA.

There’s a whole private pension industry out there literally doing absolutely nothing of any real value. They can’t provide a guaranteed income in retirement without state backing in the form of Gilts. So what is exactly the point of having them? Them taking their cut before they have it over.

The Ways and Means Account is just an infinite overdraft with the Central Bank, and it grows over time to balance the net-savings of the non-government sector just as the Gilt stock does now.

The Scottish Treasury simply doesn’t issue any Gilts/ debt any more. Any funding of private pensions in payment should be done by offering annuities at National Savings, which would also have the neat side effect of ‘confiscating’ net savings and making the deficit go down.

It’s irrelevant what interest the Scottish central bank charges on the ‘Ways and Means’ account since any profit the central bank makes from it goes back to the Scottish treasury anyway. So it can 50% if that gives the necessary level of satisfaction to mainstream economists.

What you have is a standard intra-group loan account between a principal entity (Scottish Treasury) and its wholly-owned subsidiary the Scottish central bank. Normally those sort of loans are interest free for the fairly obvious reason that interest charging is utterly pointless, and they are perpetual for the same reason. Rolling over is totally pointless.

Any term money can then be issued to the commercial banks directly by the Bank of Scotland – up to three month bills.

From day 1 of independence The only bonds we need are Granny bonds – Period.

LikeLiked by 1 person

Once we fully understand pensions are a PRODUCTIVITY story and NOT an affordability story. That brings us to the Paradox of productivity.

So what is the Paradox of Productivity ?

The neoclassical Keynsian, monetarist and Austrian view still believes that the economy tends to fix itself. If we just sit back economic growth will go back to its maximum.

Unemployment will drop to 2% what we consider full employment but it might need some help now and then. The Paul Krugman mainstream view. That There are no business cycles. Remember that when the globalist neoliberal UK Parliament claimed the business cycle is dead.

However, the truth is you could have the purist free market economy in the world but still have big unemployment numbers because the system tends to move towards breakdown.

Why ? Why does the system tend to move towards breakdown ?

Why can’t it be that higher wages force firms to invest in better management techniques and the most advanced technologies in order to get the most out of their higher cost labour?

That’s known as the paradox of productivity. Productivity improvements just lead to falling prices, so firms try to avoid doing productivity improvements and prefer to try and obtain monopoly power instead. That’s what a ‘market niche’ is.

Oh boy have we seen this monopoly power as the public sector was transformed into rent seeking monopolies. Energy companies for one during the supply side constraints. I will go into that in more detail later.

Higher wages will lead to some firms failing, which releases people onto the labour market, driving down wages. If you try to hold those jobs up, and force losses onto the other side you end up with an investment strike and the whole house of cards collapses into stagflation. Remember when privatised companies tried to hold the government to ransom by refusing to invest during the pandemic.

Failing to match higher wages with higher product must result in both investment capital and the demanding wage earners taking a cold bath. The economic system is a referee. It must not favour either side in the football match.

And why would firms in a competitive capitalistic system ever try to avoid productivity improvements?

Simple-

Compare the cost of a concert violinist to a loaf of bread in the 19th century vs today. That’s what productivity increases do over time – because it takes less human time to produce an item, and time is really what everything ends up being priced in.

That’s the paradox of productivity. Productivity improvements ultimately leads to cheaper prices not increased profits. Because that’s what competition is there to do. The profits can go further – in that they can buy more stuff. But capitalists like to accumulate units of account.

In essence the dynamics of pure competition leads to an oversupply in the market which brings prices down until firms start to go bust to eliminate the oversupply. Therefore market players try to stop competition happening by constantly seeking a monopoly perch on which to extract rent.

Oh boy we have we seen this happening time and time again. With a big 2 or 3 in each sector rigging prices between themselves.

The myths of free market beliefs say it all sorts itself out. It clearly doesn’t. The system has to force competition onto essentially reluctant players, and eliminating the clarion call of “what about the jobs” is one way of doing that – let bad firms go bust.

A company that can produce more with the same inputs (costs) is going to do that if there is a market for their product.

That’s the HUGE problem. Because the costs is the income that is used to buy the products ( in aggregate).

If you expand output then you are selling to the same income which implies that the price must go down to shift the increased amount of stuff. Theoretically their competition will eventually learn to do the same and the excess profit will disappear.

Not theoretically. This is exactly what happens. The dynamics of market share maintenance kicks in and prices go down. You get a short uplift and then a nose dive. When you have been in business long enough you know it is better to find a niche than run up and down this escalator. Because items are ultimately priced in a person’s time used to make them. When it boils down to it actual demand must match actual supply at the point of EFFECTIVE demand.

THE job guarentee fixes that and ratches competition up to mach 10. By flattening the Phillips curve.

Here:

LikeLike

And, theoretically, the Job Guarantee underpins all of this i.e. price stability and job security:

Job Guarantee – The Gower Initiative for Modern Money Studies (gimms.org.uk)

It’s a value judgment:

Provide cheap pool of private sector labour with minimal rights (via Natural Rate of Unemployment)

versus

Give people the dignity of decent work and pay (via Job Guarantee)

LikeLiked by 1 person

Finally and Always Very important with a Glasgow example from a different century.

Sorry for the length Iain but PRODUCTIVTY is key now we understand nothing is an affordability issue.

We shouldn’t even be thinking about joining EFTA. It has free movement of people as a core principle.

A skills based immigration policy is what improves our productivity. Not open borders – it is about doing more with less.

Back in the 1920’s a guy called Hotelling started to look at Monopolistic competition in terms of location and used the example of where would 2 ice cream sellers on a beach locate themselves. From a social point of view you would think they should locate themselves about one quarter way in on one side of the beach. The other seller would do the same at the other end of the beach. So that they divided the market in two and the consumers could access the ice cream. You would end up with a long beach with a seller at each end a quarter way in on the beach.

Hotelling then says let’s assume the ice cream sellers are mobile and one ice cream sellers moved a bit closer to the centre. In terms of distance starts to steal some of the consumption of the other seller. Which then forces this seller to move a bit closer to the middle of the beach to try and get it back. Hotelling noticed that what happens is eventually you end up with both sellers right in the centre of the beach beside each other. This is not optimal from the stand point of those in the long beach that would like to buy ice cream. The social optimum for the consumers and that is have the seller’s spread out across the beach has been destroyed by the competition between the 2 sellers. The 2 sellers will eventually come to a monopolistic agreement regarding their prices.

Then Hotelling says what happens if a 3rd seller sets up on the beach. Everything becomes unstable as the 3 sellers set up in different places on the beach every day and prices become unstable. Until eventually all 3 end up in the same place in the beach and work together.

Why in cities you have districts that sell the same product. You would expect them to be all over the city but you end up with Jewellers all in one area. Pubs and nightclubs, shopping centres, DIY stores.

So when you get a big 3 or 4 in any sector what do they do. What do the energy companies do ?

They head to the centre of the beach and form a MONOPOLY and work it between themselves how to extract the most rent as possible and take turns at hiking prices for their services.

They turned the public sector into a rent extracting MONOPOLY.

Remember all the companies who put their prices up right after the Brexit vote. Weetabix and the rail operators and the rest followed for no other reason apart from greed.

They threaten investment strikes and try and hold elected governments to ransom.

The free market tooth fairy believes that people are mutable between professions at the snap of a finger. That bakers can become engineers and Marks and Spencer cleaners can become train drivers the next day.

That people can be moved around like ignots of steel. They have found out the hard way this is never the case.

When people are unemployed there is never a list of private sector employers sat there with cheque books at the ready. When a down turn happens unemployment spreads through communities like a virus. Regardless what the free market tooth fairy says.

Why we need a job guarentee.

Finally, as soon as UK workers get some pricing power these companies run to Nanny and scream for cheap Labour from abroad. Exactly like they did after brexit.

Why does the UK import Labour ? What with x unemployed, y inactive but want a job, and z part timers wanting full time work, why do we need any more?

It’s relatively straightforward. The British Labour market suffers from the ‘British disease’ — a vestige of Imperialism. We find it easier to steal resources from other countries than to create our own.

There is about 10% of the working population unutilised in the workforce one way or another. And that’s before we get onto people over 65, who are automatically excluded despite the state pension age creeping ever higher.

None of these match the vacancies on offer.They don’t match for several reasons:

a) The job role demands a skill set that is not available at the price offered.

b) The job is in the wrong geographical location from the people who could do it

c) The job has physical requirements that are not available at the price offered

So the process of filling a job goes something like this:

1. Business advertises for a person to work very long hours for a pittance, often somewhere ridiculous like London.

2. Nobody appropriate applies for it.

3. Business goes running to nanny shouting ‘skill shortage’ and demands visas.

4. Government gives in to business because businesses are treated like pets, not cattle.

5. The job is advertised abroad.

6. Foreign nations, exporting their people like cargo, welcome the visas and encourage people to leave rather than sort the social problems out at home.

So the elite class in both countries get what they want.The poor country gets rid of their peasants that are competing for what little resources there are and who may send some foreign currency back which the elites can appropriate through taxes, financial discounting or even occasionally producing goods for people.

The rich country gets cheap labour that will stack high in tenement blocks and work all hours for a lower wage. The elite cream off the surplus and socialise the losses onto the school system, the health system and the social services who then advertise for people to expand and find that there aren’t any skilled staff to work in those areas. The public sector then asks for visas, advertises abroad…

What you get, in effect, is the same process at a country level that we had initially in the industrial revolution at a city level. 1840’s Manchester followed the same process, but with the surrounding rural areas rather than areas thousands of miles away in a different country. Birmingham, Glasgow and others followed the same process.

It will end up in the same way it always does — the rich living in gated wonderlands while the poor live in slums squashed in like sardines. Shanty towns are what happen when you allow market forces free rein. The UK had the first shanty towns, and the way it is run at the moment it will be the first shanty country.

It’s not just at the low level this process happens. Agriculture is notorious for it, but it also happens in IT. The larger firms put pressure on the government to let them import ‘skilled staff’ just as soon as the British workers develop any pricing power.

In reality they just want to pay less, and the prevailing economic orthodoxy uses a ‘reserve army of the unemployed’ to keep wages under control. In their belief system, inflation control has to be done on the labour side of the equation, never on the capital side. That why we have concepts like NAIRU, but never a NAIRC (non-accelerating inflation rate of competition).

When you look at a country with a different approach — Japan — you find, that even with a declining population and GDP relatively static overall, the GDP per capita is rising. That’s because they are automating and treating their elderly with respect. Fast food places are closing because they can’t get the staff. People get their cars washed by machines and their coffee from machines. All that drives forward productivity which then maintains and improves the standard of living — because they have to.

It’s not all perfect. The Japanese elite are gripped with neoliberalism like everywhere else. There is unnecessary unemployment and unhappiness. There are strong pushes for more ‘guest workers’. But the language, writing barrier and general culture stops them throwing open the doors. They have developed a different way for an island nation to bumble along relatively happily but with a net migration rate of about zero.

When you read any of the immigration literature put out by economists have a look and see if you can find Japan mentioned. You won’t find them in there — because it doesn’t fit the prevailing narrative.

So there is another way to improve standard of living rather than going around nicking resources from other nations. But it means treating business like cattle rather than pets. It means elites having to address local problems and innovate rather than sweeping them under the carpet.

But to do that you have to dump the neo-liberal economic attitude and the bizarre focus on people overseas ahead of people here who actually may vote for SALVO.

Leaving the EU. We have been freed from the straitjacket. Asking for it to be put back on, because the new movement in your arms and legs is scary, looks a bit bonkers to anybody outside the echo chamber.

The growth strategy of the UK has been for many years “import cheap labour to keep the middle classes in their delusions of grandeur”. It’s actually called The British Growth Model. But we didn’t reject New Labour to have it replaced by Cheap Labour.

Our future must lie in improving productivity and increasing investment so that we can do more things with a stable population and a sustainable ecology. And a constraint on the labour supply is one of the ways that gets done. Employees should always be reassuringly expensive to force the capitalists to invest and innovate.

Our international strategy must be to encourage other nations to follow our lead in pushing productivity and increasing investment, and solve their unemployment problem at home rather than exporting it. That means that activity needs to move to where the people live.

Bizarrely we appear to be focussed upon national GDP figures and international people, when, in a nation, the focus should be the other way around — international growth figures and the local people who actually vote for you. It shouldn’t matter where the work gets done as long as it is more productive and less resource intensive than before.

But to do that you have to have an immigration system that works. Here’s a precis of one that will (but remember that the devil is in the detail):

An immigration system that excludes immigrants that wouldn’t otherwise get a work visa instantly removes all those people who come here and compete with the UK working-class sub-median wage earners. These were the people who voted in the largest numbers for Brexit. These people have paid the heaviest price for EU membership.

Reintroducing a work visa system that is on same lines as every other civilised advanced nation outside the EU, solves that problem.

Then only higher waged, higher skilled individuals come into the country from all over the world, but they compete with a different class of people in the UK and compete less because they are in areas with GENUINE skill shortages.

From the point of view of the UK sub-median wage earner, immigration has ended. So they are happy.

And importantly you need to send out higher skilled individuals from the UK to the rest of the world to balance those you take in. Otherwise you are stealing skills from other nations which they need to develop internally. That is a ‘beggar-thy-neighbour’ attitude and morally unacceptable. Immigration should be more of an informal exchange process than a capitalist ‘free market’.

This is a civilised solution that addresses all the concerns. Eminently reasonable and fair to all who believe in sovereign nations and borders. A win-win all round.

Free movement of people a core principle of EFTA has given life back to the far right across Europe with immigration being their number one agenda. With a skills based immigration policy to improve our productivity this would never have happened.

LikeLiked by 2 people

If this was on paper Derek you would be facing a hanging in what’s left of the Brazilian Rain Forest. Lol

LikeLike

🙂

LikeLike

This is fascinating. Thank you. But, isn’t EFTA a two tier organisation. Switzerland doesn’t have free movement of people but does benefit from EFTA’s free trade agreements. So perhaps there’s a half way house.

I read constantly of skills shortages in our population but little seems to be done practically to address it. All home grown solutions take time but we have to start somewhere. A subsidy enabling our universities to take suitably qualified Scottish students in all shortage health professions from doctors to dentists to speech and language therapists to midwives. It takes years for the end result to qualify but time we made a start. Likewise encouraging small businesses to take on apprentices through financing them appropriately.

We need some creative long term policies. That pesky vision thing that seems to be sadly lacking.

LikeLiked by 1 person

Reading all that has given me a headache and I realise I have never understood the workings of money – a simple soul who had enough to get by . I am going to have to reread and study all the input under the line too – paracetamol , calculator and pen and paper at the ready.

Thanks for setting me on the road.

LikeLiked by 5 people

Lots of study and re-reading after this post.

All very interesting once again Iain.

Great Post.

and who says we wouldn’t manage to run our country.

I do see lots of obstruction however.

LikeLiked by 3 people